We build & manage safe, quality, affordable housing across the Twin Cities, with support services to create stability and pride.

How We Help

Readiness programs provide participants with the skills necessary to get and keep a job with proven income growth and job placements.

Top Results

A leading-edge model for analyzing & strengthening programs

Stable Housing

Long-Term Jobs

3x

a 3x growth in their income.

The PPL of PPL

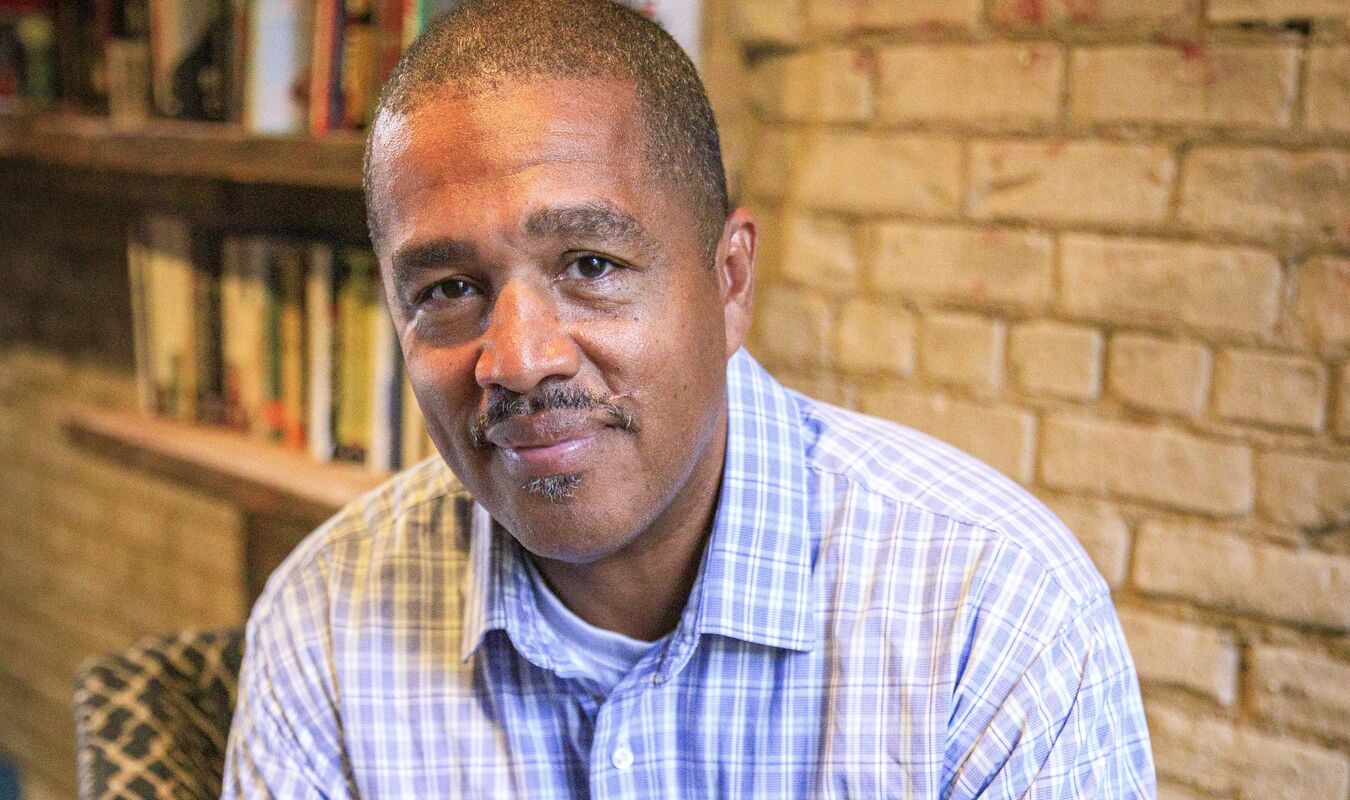

"PPL kept me grounded and gave me a safe place to go to. It was a miracle - I don’t know where I’d be without PPL. It’s never too late to be what you want to be."

- Jason, PPL Career Training Graduate

“With the PPL family and staff, I’ve felt like I have a real family helping to make my dreams come true.”

- Tameka, PPL Resident and Access Lab Client

"It’s amazing – I would never have imagined I would have gotten to this point. I’m just grateful to be able to redeem myself. It feels like I’ve been given a second chance to do the right thing."

- Jordan, PPL Resident

"If I could do it for [my children], I can do it for myself. I’ve become stronger. There’s no such thing as ‘can’t,’ and rejection doesn’t last forever.”

- Erica, PPL Diploma Connect Student

"Whenever a door closes another one opens. You can restart from ground zero.”

- Bella, PPL Career Training Graduate

"It’s nice to have ongoing support [through PPL]. I get a response and more than help right away. It’s like buying a house from a family member rather than a stranger."

- Bashe, PPL RE-Seed Property Buyer

"PPL has done a wonderful job with providing resources and guidance to help meet my needs in my work, school, and personal life. I really appreciate the inclusion and support I’ve received from my colleagues, fellow apprentices, and from PPL."

- Ashanti, PPL Aon Apprenticeship Graduate